Content

Relative purchasing power parity is when the ratio of the changes in the price level in two different countries is proportional to the change in the equilibrium exchange rate. According to relative purchasing power parity, when there are differences in the price levels between two countries, these differences will cause the exchange rate between two countries to change. The new exchange rate, influenced by the differences in the price level, will converge towards a new equilibrium point where price levels are at the same level. If the nominal exchange rate was more volatile, then it suggested that relative price levels were adjusted more slowly compared to the nominal exchange rates.

The idea in the law of one price is that identical goods selling in an integrated market in which there are no transportation costs, no differential taxes or subsidies, and no tariffs or other trade barriers should sell at identical prices. If different prices prevailed, then there would be profit-making opportunities by buying the good in the low price market and reselling it in the high price market. If entrepreneurs took advantage of this arbitrage opportunity, then the prices would converge to equality. The relationship between the absolute and relative purchasing-power-parity (PPP) theories is restated theoretically. Then the relative PPP theory is tested using the GDP deflator and the cost of living as price-level concepts. The time periods are encompassed by 1950–1975; the countries are mainly but not exclusively in the Western industrial mode.

Where γp is the new relative weight attributed to welfare of citizens in the nontradable sector, now taking the political factors into consideration. A technological shock increases domestic economic productivity in relation to the rest of the world. Following PPP theory, this would mean that over time, the Danish krone should increase by 6.6% to parity with the US dollar. The burger was chosen due to the global reach of McDonald’s, with an estimated 36,889 outlets in 120 countries.

The formula that is used to compute the PPP exchange rate is the price of the basket of goods in currency A divided by the price of the same basket of goods in currency B. When explaining trade between countries, PPP does not consider the transportation cost of moving goods between nations. It is much more expensive to bring goods from China to the US than from the UK to the US. This makes imported goods more expensive, which is not necessarily reflected in the exchange rate. For example, a local currency that PPP has assessed to be highly overpriced might be predicted to fall in value relative to frequently traded currencies such as the United States dollar over time.

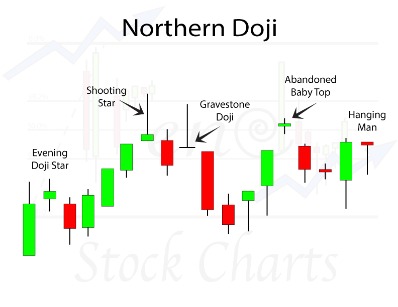

How much does trading cost?

Purchasing power parity is both a theory about exchange rate determination and a tool to make more accurate comparisons of data between countries. It is probably more important in its latter role since as a theory it performs pretty poorly. Nonetheless, the theory remains important to provide the background for its use as a tool for cross-country comparisons of income and wages, which is used by international organizations like the World Bank in presenting much of their international data. Looking at military spending this way reveals that real military spending in many countries is indeed far larger than the values implied by market exchange rates.

- In addition to the disclaimer below, the material on this page does not contain a record of our trading prices, or an offer of, or solicitation for, a transaction in any financial instrument.

- It is quite common to hear people claim that a country’s exchange rate is overvalued or undervalued.

- However, using PPP estimates, India’s GDP in 2019 was closer to $9.5 trillion—roughly 44 percent of the U.S.

- Converting this to renminbi at the market exchange rate gives enough renminbi to pay for two to four colonels in the People’s Liberation Army, given a monthly salary of RMB 20,000 as reported by The South China Morning Post (2021).

- For many countries, the difference between exchange rates and PPP estimates is relatively small.

- If the PPP rate indicates a currency is over-valued compared to another, then a trader would consider going short on the currency in question.

According to an Augmented Dickey-Fuller test, the series would be stationary if it was able to reject the null hypothesis of a unit root. Because the cost of a market basket of goods is used in the construction of the country’s consumer price index, PPP is often written as a relationship between the exchange rate and the country’s price indices. However, it is not possible merely to substitute the price index directly for the cost of the market basket used above. To see why, we will review the construction of the CPI in Chapter 17 “Purchasing Power Parity”, Section 17.2 “The Consumer Price Index (CPI) and PPP”. This, however, is true of all international comparisons of military spending, irrespective of what exchange rate concept is used.

What is purchasing power parity?

In another vein, PPP suggests that transactions on a country’s current account affect the value of the exchange rate on the foreign exchange (Forex) market. This is in contrast with the interest rate parity theory, which assumes that the actions of investors (whose transactions are recorded on the capital account) induce changes in the exchange rate. This is illustrated in Figure 1 which shows that when using market exchange rate-based measures of GDP, 63% of the global economy is ascribed to high-income countries and just 9% to lower-middle-income economies. This difference reflects the undervaluing of the economic size of most global economies with relatively low prices when using market exchange rates. For many countries, the difference between exchange rates and PPP estimates is relatively small.

Since it is less than the ratio of the market basket costs in Mexico and the United States, it is also less than the PPP exchange rate. The right side of the expression is rewritten to show that the cost of a market basket in the United States evaluated in pesos (i.e., CB$Ep/$) is less than the cost of the market basket in Mexico also evaluated in pesos. Thus it is cheaper to buy the basket in the United States, or in other words, it is more profitable to sell items in the market basket in Mexico.

In addition, we recognize that the exchange rate is not solely determined by trader behavior. Investors, who respond to different incentives, might cause persistent deviations from the PPP exchange rate even if traders continue to respond to the price differences. First, let’s define the variable CB$ to represent the cost of a basket of goods in the United States denominated in dollars. For simplicity we could imagine using the same basket of goods used in the construction of the U.S. consumer price index (CPI$). The consumer price index (CPI)An index that measures the average level of prices of goods and services in an economy relative to a base year.

The Doctrine of Relative Purchasing Power Parity

However, in reality, it might be unlikely to achieve due to external factors including different transaction costs and some restrictions for some traders to participate in some markets. ‘Relative PPP’ is said to hold when the rate of depreciation of one currency relative to another matches the difference in aggregate price inflation between the two countries concerned. If the nominal exchange rate is defined simply as the price of one currency in terms of another, then the real exchange rate is the nominal exchange rate adjusted for relative national price level differences. When PPP holds, the real exchange rate is a constant so that movements in the real exchange rate represent deviations from PPP.

These are 83.9 and 122.8 yen per dollar for industry and household uses, respectively. The model must reconcile these observed prices, that is, the PPP for industry use is slightly above the import PPP, while the PPP for household use is significantly above the PPP. By stripping off the margins paid on sales to households and industry, the model estimates that the internally consistent producer-price PPP of the Motor vehicles and trailers is estimated to be 79.9 and 95.8 yen per dollar for industry and household use, respectively. Finally, as a composite of the products produced for https://g-markets.net/helpful-articles/spinning-top-candlestick-pattern-comprehensive/ industry and household, the PPP for output is estimated to be 87.9 yen per dollar. At the exchange rate of 79.8 on average in 2011, using the PPP for household purchases of motor vehicles (122.8) yields a considerably different (and conceptually inappropriate) measure of competitiveness compared to the (conceptually appropriate) 87.9 yen per dollar. However, the other remaining five currencies of LAK, MMK, MYR, PHP, and THB which belonged to Lao PDR, Myanmar, Malaysia, Philippines, and Thailand were not integrated of order zero and it failed to reject the unit root hypothesis.

The change in emission intensity over time and across countries can be measured using GDP in constant 2017 PPP terms (Figure 7). PPPs allow cross-country analyses of national expenditures made on goods and services. This type of analysis can help us understand the cost of, or the investment made, in different aspects of human development, such as health expenditures. The chart below highlights regional differences when it comes to public, private and external per capita health expenditure, using WDI PPP-based indicators (Figure 5). A number of these PPP-based indicators are featured in the WDI database and a few are highlighted below.

The formula for purchasing power parity (PPP) is Cost of Good X in Currency 1 / Cost of Good X in Currency 2. This allows an individual to make comparisons of currencies and the value of a basket of goods they can buy. The term itself is generally used by economists to represent some “unspecified” long period of time; it might be several months, years, or even decades. Also, since the target, the PPP exchange rate, is constantly changing, it is quite possible that it is never reached. The adjustment process may never allow the exchange rate to catch up to the target even though it is constantly chasing it. Thus we need to explain why the exchange rate will change if it is not in equilibrium.

How to calculate purchasing power parity?

If this is the first time you use this feature, you will be asked to authorise Cambridge Core to connect with your account. Slippage is created between the price index that underlies PPP and the specific prices that are of interest to the hedger. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate.

From empirical evidence, exchange rates seem to deviate from PPP in the short run, but PPP tends to hold in the long run. The PPP-based poverty lines are also used to monitor progress towards universal health coverage. The number of people pushed below the current $1.90 and $3.20 poverty lines by ‘out-of-pocket’ health care expenditures show the number of people living in households experiencing impoverishing levels of health expenses.

- Purchasing power parity is the nominal exchange rate that would make the purchasing power in one country equal to that of another country with a different currency.

- Absolute purchasing power parity suggests that the two countries’ price ratio is equal to the equilibrium exchange rate between the two countries.

- The right side gives the differences in the inflation rates between Mexico and the United States that were evaluated over the same time period.

- China rises from the third largest economy using current exchange rates to the second largest using PPP.

- More Prius’s would be purchased, and more dollars would be supplied to convert to yen.

In 2011, the PPP adjusted poverty line was set at $1.90 per day – indicating that anyone who earns less than this globally is considered to be in extreme poverty. The law of one price is based on the idea that other things being equal, identical items sold on a worldwide market should have the same price. Purchasing power parity (PPP) is used to evaluate the current exchange rate between two countries. Any exchange rate above or below the PPP suggests that one of the currencies is overvalued or undervalued.

Casual examination of the empirical evidence reveals that real exchange rates for many currencies do deviate significantly from the PPP requirement that the real exchange rate must be relatively constant over time. The findings based on the Augmented Dickey-Fuller statistics on the unit root of the real exchange rate revealed mixed results from the ten countries. However, the relative purchasing power parity was not valid in the other remaining five countries of Lao PDR, Myanmar, Malaysia, Philippines, and Thailand since it failed to reject the null hypothesis in an Augmented Dickey-Fuller test. In this study, the validity test on the relative purchasing power parity was investigated by performing an analysis on the association between the nominal exchange rate and the relative consumer price index.

Thus, the results implied that the relative purchasing power parity did not hold in these five markets during the period under the study. Figure 1 displayed the real exchange rate series to be examined by the Augmented Dickey-Fuller test. An estimation of the series was calculated based on the nominal exchange rate adjusted by the relative price level. I.e., natural log transformation of the nominal exchange rate times the relative consumer price index. These dramatic differences stem from another drawback of market exchange rates—they are based solely on the value of internationally traded goods.

One we add this concept onto APPP, we can see that inflation rates will account for part of the change in the power of currencies. So suppose that the UK has a 2% inflation rate, while Brazil has a 5% inflation rate. This means that after one year, the price of a basket of goods in Brazil has increased by 5%, while the same basket of goods in the UK has only increased by 2%. Absolute purchasing power parity (APPP) is the basic PPP theory, which states that once two currencies have been exchanged, a basket of goods should have the same value. Usually, the theory is based on converting other world currencies into the US dollar. An example of absolute purchasing power parity would be the price of tacos in the US and Mexico.

Transport Costs

In fact, PPP held only at times when the exchange rate plot crosses the market basket ratio plot; on the diagram this happened only twice during the century—not a very good record. Relative purchasing power parity (RPPP) is an extension of APPP and can be used in tandem with the first concept. While it maintains that the value of the same good in different countries should equal out over time, RPPP suggests that there is a correlation between price inflation and currency exchange rates.